- Home

-

Tax Topics

- Study Guides and More

- Recordings of Trainings

- Volunteer Agreement

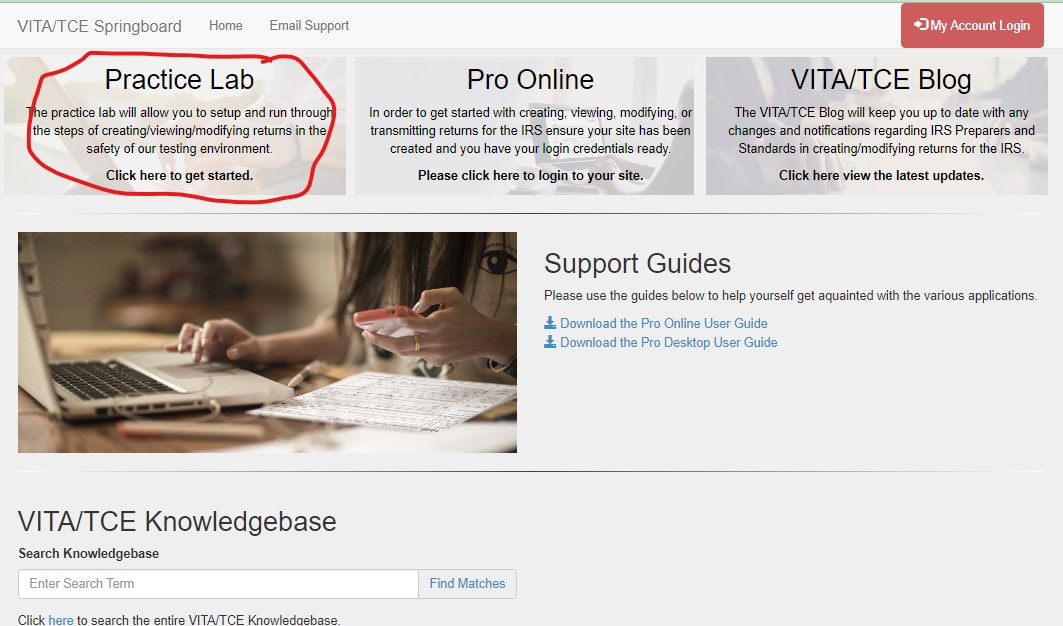

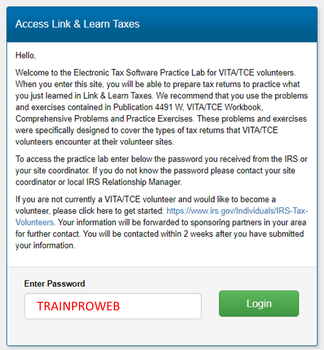

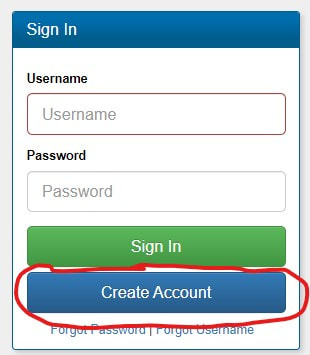

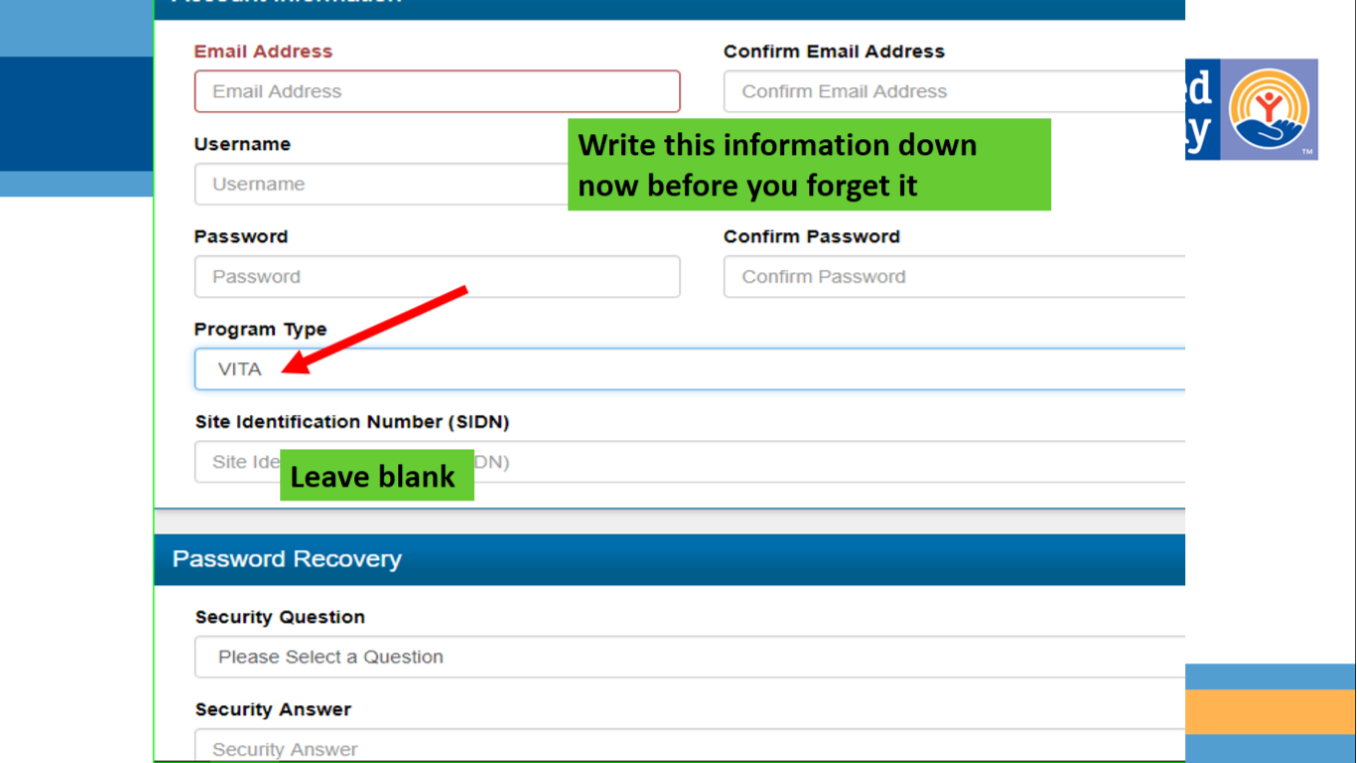

- PRACTICE SCENARIOS

- Site Coordinators

- Amendment

- Spanish/Espanol Training

- Foreign Student

- W-7 ITIN APPLICATION

- FAFSA

- VALET & VIRTUAL

- CERT ACCEPT AGENT

- Financial Literacy

- LITC

- CE CREDITS

- POA

- Transcripts

- Interpreters

- MASKED TRANSCRIPTS

- Misc Info

- Customer Portal

- PRESEASON WORKSHOP

- For Clients

- New Host Site Info

- Missing SSA-1099

- United Way of Lee, Hendry & Glades

- ID.ME

- Age Reference

- Changes

- Extensions

- Financial Education

- Casualty

- Untitled

- Volunteer Recruitment

- Marketing

- Tax Instruction

- State Taxes

- Dear Iris

- Practice Quizzes

- New Volunteer Orientation

- High School Training

- New Page

- Home

-

Tax Topics

- Study Guides and More

- Recordings of Trainings

- Volunteer Agreement

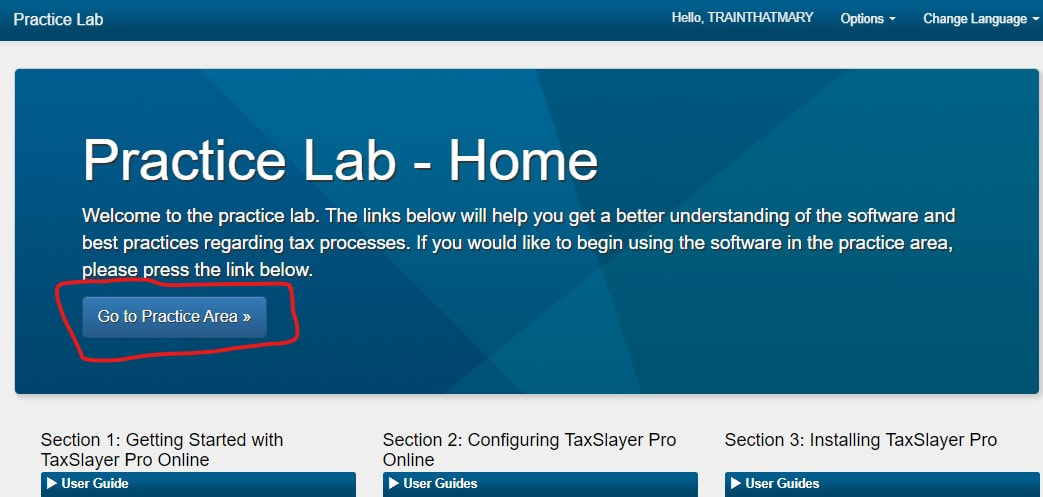

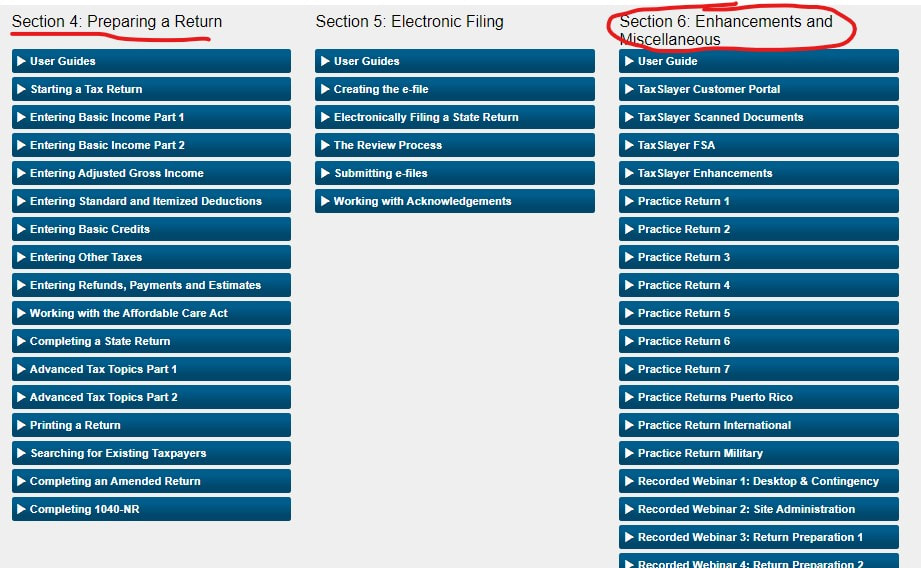

- PRACTICE SCENARIOS

- Site Coordinators

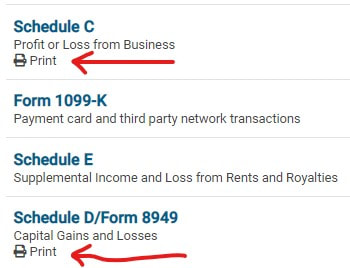

- Amendment

- Spanish/Espanol Training

- Foreign Student

- W-7 ITIN APPLICATION

- FAFSA

- VALET & VIRTUAL

- CERT ACCEPT AGENT

- Financial Literacy

- LITC

- CE CREDITS

- POA

- Transcripts

- Interpreters

- MASKED TRANSCRIPTS

- Misc Info

- Customer Portal

- PRESEASON WORKSHOP

- For Clients

- New Host Site Info

- Missing SSA-1099

- United Way of Lee, Hendry & Glades

- ID.ME

- Age Reference

- Changes

- Extensions

- Financial Education

- Casualty

- Untitled

- Volunteer Recruitment

- Marketing

- Tax Instruction

- State Taxes

- Dear Iris

- Practice Quizzes

- New Volunteer Orientation

- High School Training

- New Page