- Home

- Train From Home-Getting Started

-

Training Checklist

- Study Guides and More

- Recordings of Trainings

- Volunteer Agreement

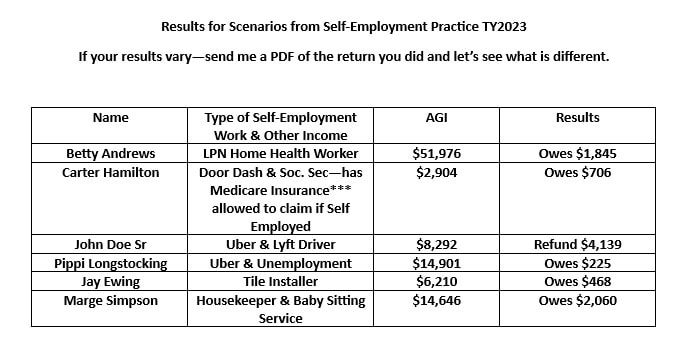

- PRACTICE SCENARIOS

- Site Coordinators

- Amendment

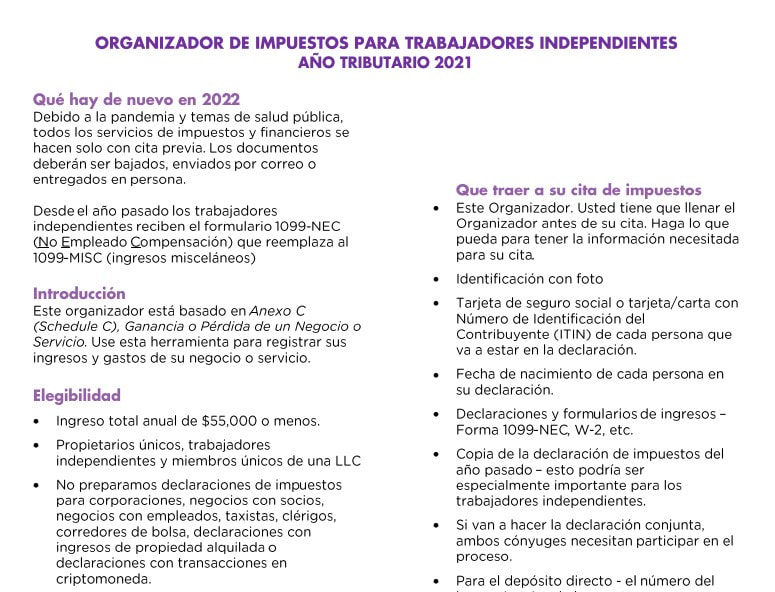

- Spanish/Espanol Training

- Foreign Student

- W-7 ITIN APPLICATION

- FAFSA

- VALET & VIRTUAL

- CERT ACCEPT AGENT

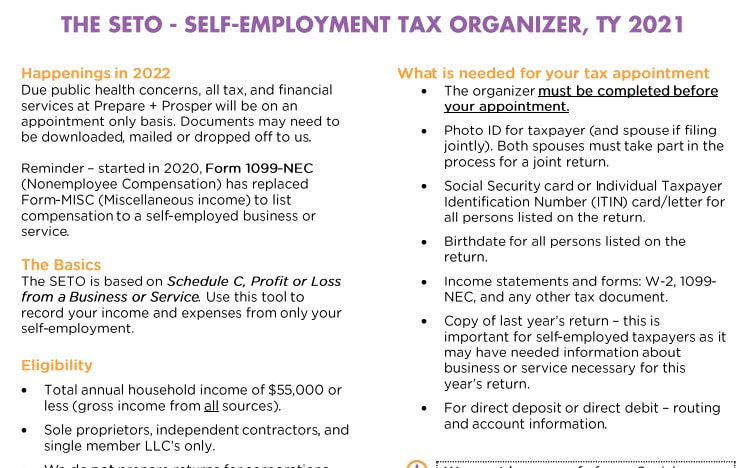

- Financial Literacy

- LITC

- CE CREDITS

- POA

- Transcripts

- Interpreters

- Misc Info

- Customer Portal

- PRESEASON WORKSHOP

- For Clients

- New Host Site Info

- United Way of Lee, Hendry & Glades

- Age Reference

- Changes

- Extensions

- Financial Education

- Casualty

- Recruitment

- Marketing

- Tax Instruction

- State Taxes

- Dear Iris

- Practice Quizzes

- New Volunteer Orientation

- High School Training

- Partner with VITA

- MARYS OOS STUFF/NOTES

- State Contacts

- Help with Tax Issues

- Home

- Train From Home-Getting Started

-

Training Checklist

- Study Guides and More

- Recordings of Trainings

- Volunteer Agreement

- PRACTICE SCENARIOS

- Site Coordinators

- Amendment

- Spanish/Espanol Training

- Foreign Student

- W-7 ITIN APPLICATION

- FAFSA

- VALET & VIRTUAL

- CERT ACCEPT AGENT

- Financial Literacy

- LITC

- CE CREDITS

- POA

- Transcripts

- Interpreters

- Misc Info

- Customer Portal

- PRESEASON WORKSHOP

- For Clients

- New Host Site Info

- United Way of Lee, Hendry & Glades

- Age Reference

- Changes

- Extensions

- Financial Education

- Casualty

- Recruitment

- Marketing

- Tax Instruction

- State Taxes

- Dear Iris

- Practice Quizzes

- New Volunteer Orientation

- High School Training

- Partner with VITA

- MARYS OOS STUFF/NOTES

- State Contacts

- Help with Tax Issues